try our mobile application

coming soon

budget

How will the next 30 years of investment performance benefit you? No one can say for certain, but you can look at the past to get an idea.

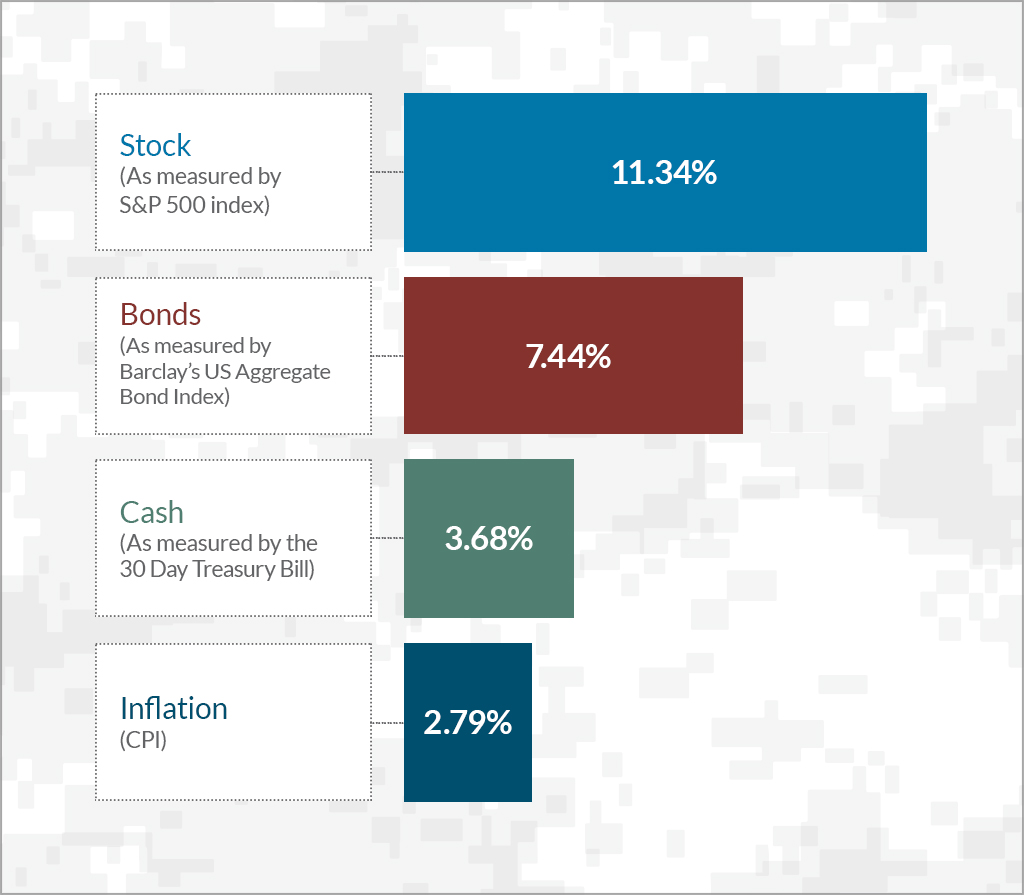

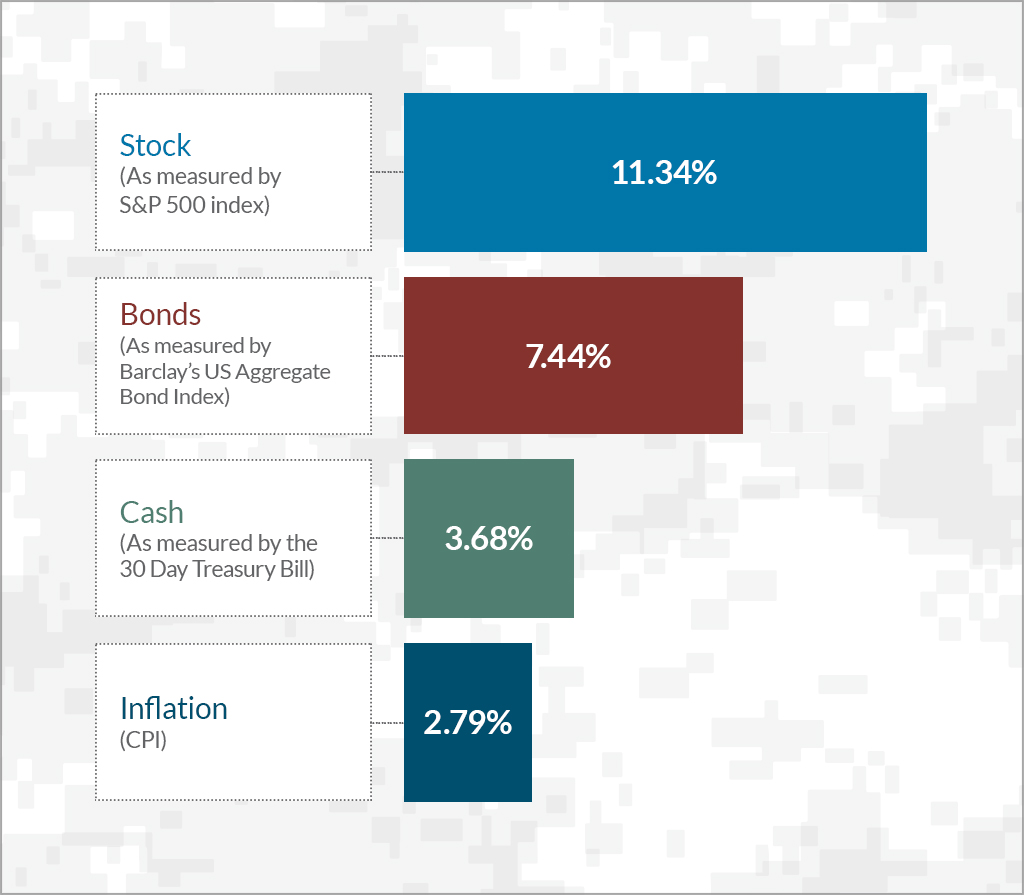

In the past 30 years of investing, stocks outpaced bonds, and bonds beat cash. In the big picture, all investments went up, though cash barely outpaced inflation. Average annual returns* looked like this:

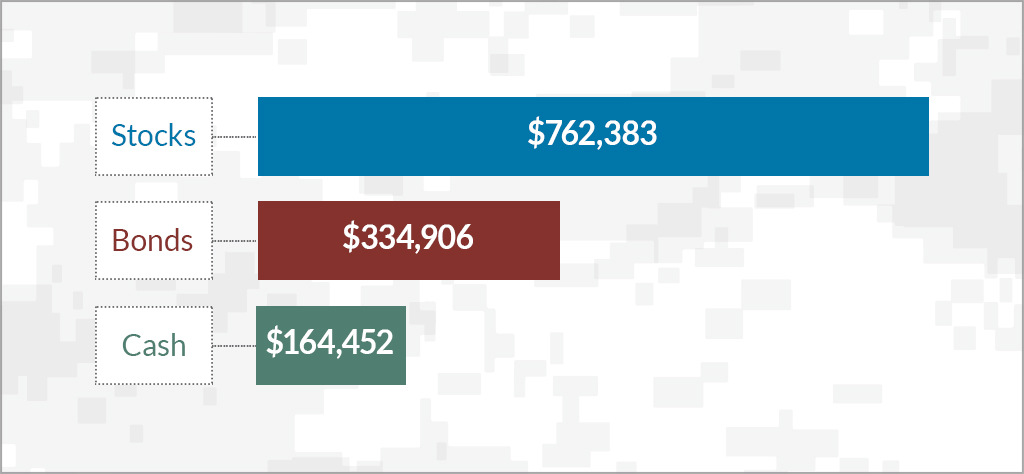

So what? Well, if we assume average annual returns over then next 30 years will be equal to the last (unlikely, but still helpful to contemplate), investing just $250 each month in stocks, bonds, or cash will get you this far:

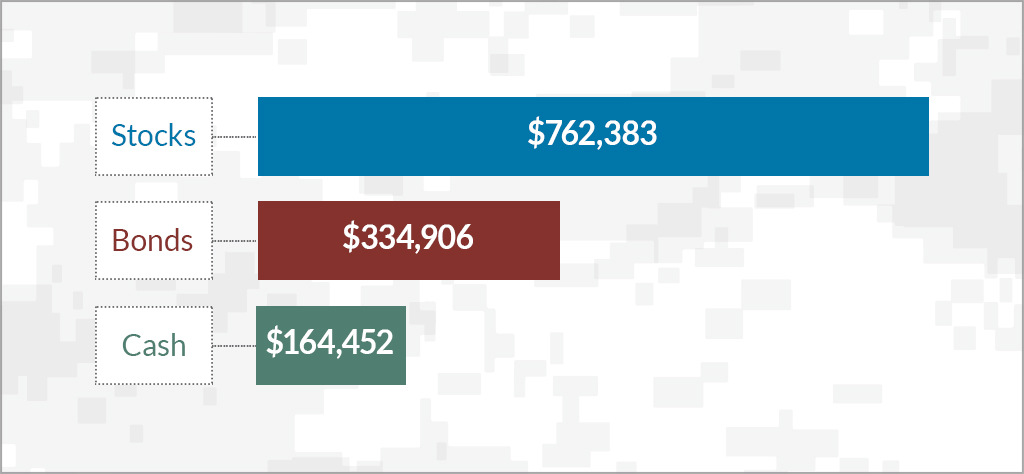

Cool, right? Another way to think about this is to reverse engineer it. Think about how much money you’d like to have 30 years from now, then calculate how much you’d need to set aside to hit that number in each investment category. To get to that nice $762,000 from above, you’d have to invest about:

In this example, stocks look pretty good, huh? It would take just $250 per month or $90,000 total invested over time to end up with more than $762,000. Getting to the same end with savings requires total investments of $417,400.

Of course, there’s no guarantee that markets will cooperate. To reach your financial goals with investing, you need a long time frame and a smart mix of stocks, bonds, and cash investments. And you’ve got to get started.

* According to Ibbotson Associates, Morningstar Direct total return data for the 30 year period ending 12/31/2014 using the following proxies: Cash – 30 day Treasury Bills. Bonds – Barclay’s US Aggregate Bond index, Stocks – S&P 500 index. Inflation data from Bureau of Labor Statistics (www.bls.gov/data).

Copyright © Personal Finance For Military Life • Privacy Policy

#4b3264

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/blended_retirement_icon_white-1.svg

Blended Retirement

#af7800

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/budget_icon_white.svg

Budget

#005f4d

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/credit_icon_white-1.svg

Credit

#8a322a

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/debt_icon_white-3.svg

Debt

#121645

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/insurance_icon_white-1.svg

Insurance

#1daa58

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/investing_icon_white-1.svg

Investing

#004e28

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/legal_documents_icon_white-1.svg

Legal Documents

#122b68

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/major_purchases_icon_white-1.svg

Major Purchases

#9b0027

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/paying_for_college_icon_white-1.svg

Paying for College

#2e6891

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/retirement_icon_white-1.svg

Retirement

#006919

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2018/11/sacings_icon_white-1.svg

Savings

#0b2160

https://www.personalfinanceformilitarylife.org/wp-content/uploads/2019/04/all_icon_white.svg

Uncategorized